You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

In my opinion, the rise of oil is a positive factor for the dollar as the U.S. will become net exporters. The higher the price, the greater the returns, and a lower trade deficit and dollar strength.

EUR/USD weekly outlook: July 22 - 26

The euro pushed higher against the dollar in thin trade on Friday but dollar demand continued to be supported amid expectations that the Federal Reserve will start to scale back its asset purchase program later this year.

EUR/USD hit highs of 1.3154 on Friday, before settling at 1.3139, up 0.23% for the day and 0.62% higher for the week.

The pair is likely to find support at 1.3065, Thursday’s low and resistance at 1.3177, the high of July 17.

Demand for the dollar continued to be underpinned after Fed Chairman Ben Bernanke indicated Wednesday that the bank still expects to start tapering its asset purchase program by the end of the year.

In the first day of his semi-annual testimony to Congress Bernanke said the central bank could scale back its USD85 billion-a-month bond buying program by the end of 2013 if the economy continues to improve, but added that there was no “preset course.”

Bernanke said the economic recovery was continuing at a moderate pace but reiterated that monetary policy will remain accommodative for the foreseeable future.

Elsewhere, the euro was higher against the yen on Friday, with EUR/JPY advancing 0.39% to 132.19 at the close of trade, extending the week’s gains to 1.28%.

The yen was broadly weaker ahead of weekend elections in Japan’s upper house, as opinion polls indicated that Prime Minister Shinzo Abe’s Liberal Democratic Party would claim victory.

A victory would allow Prime Minister Abe to continue to push through a series of structural reforms aimed at spurring economic growth and fighting deflation.

read more ...

EUR/USD edges higher in quiet trade

The euro edged higher against the dollar on Monday but gains were limited in subdued trade as expectations that the Federal Reserve will start to slow its bond purchase program later this year continued to support the dollar.

EUR/USD hit 1.3170 during late Asian trade, the highest since July 17; the pair subsequently consolidated at 1.3147, edging up 0.07%.

The pair was likely to find support at 1.3088, Friday’s low and resistance at 1.3205, the high of July 11.

Demand for the dollar continued to be underpinned after Fed Chairman Ben Bernanke said last week that the central bank could scale back its asset purchases by the end of the year if the economy continues to improve, but added that there was no “preset course.”

Bernanke said the economic recovery was continuing at a moderate pace but reiterated that monetary policy will remain accommodative for the foreseeable future.

Elsewhere, the euro was lower against the yen, with EUR/JPY falling 0.44% to 131.60.

The yen was higher against the euro and the dollar on Monday after Japanese Prime Minister Shinzo Abe’s party claimed victory in weekend elections in the upper house, which will allow him to continue to push through a series of structural reforms aimed at spurring economic growth and fighting deflation.

USD/JPY was down 0.54% to 100.06, from 100.61 at the close on Friday.

The U.S. was to release private sector data on existing home sales later in the trading day.

source ...

EUR/USD gains on soft U.S. home sales data

Worse-than-expected industry data on U.S. home sales softened the dollar against the euro on Monday, as investors avoided the greenback on sentiments the Federal Reserve will keep stimulus programs in place for longer than once expected.

Stimulus programs such as the Fed's monthly USD85 billion bond-buying program weaken the dollar to spur recovery.

Fed Chairman Ben Bernanke has stressed that the U.S. central bank will follow no present timetable to taper such policies.

In U.S. trading on Monday, EUR/USD was up 0.46% at 1.3199, up from a session low of 1.3136 and off from a high of 1.3218.

The pair was likely to find support at 1.3136, the earlier low, and resistance at 1.3254, the high from June 21.

The National Association of Realtors reported earlier that existing home sales fell 1.2% to 5.08 million units in June, missing market calls for sales to rise 0.6% to 5.25 million units in June.

Sales for May were revised down to 5.14 million from a previously reported 5.18 million.

The report added sales were up 15.2% from June of last year, while average house prices jumped 13.5% on a year-over-year basis.

While the numbers indicated that recovery continues in the housing sector, markets concluded the figures were soft enough to sway monetary authorities to keep stimulus programs in place for now.

read more ...

Euro Focus: Are EZ Growth Doubts Misplaced?

Of all the major currencies, the euro will be in center focus this week. With manufacturing and service sector PMI reports scheduled for release along with the German IFO index, all eyes are on the performance of the euro-zone economy. When we last heard from the European Central Bank earlier this month, they were concerned about the outlook for the region. ECB President Draghi said that monetary policy will remain accommodative as long as needed because there are downside risk to their economic outlook. He even talked about how they are “technically ready” for negative rates. Most of the economic reports that we have received have so far validated Draghi’s concerns but this week, economists are looking for an improvement in economic activity and German business confidence. So the question is whether the ECB’s doubts about euro-zone growth are misplaced because economists are looking for stronger activity. We believe that the risk is to the downside for euro-zone data because industrial production, factory orders and investor confidence have weakened and unemployment in the region remains very high. At the same time, despite his dovish comments Bernanke confirmed last week that the Federal Reserve is looking to taper and the prospect of higher U.S. yields should cap gains in the EUR/USD.

Meanwhile Portugal’s coalition parties and main opposition party failed to reach an agreement but according to President Silva, the current government has enough majority to avoid early elections. Holding elections before 2015 would have created renewed political uncertainty for the country, the region and its currency so this was an ideal scenario for Portugal and the euro. No euro zone economic reports were released Monday. Tuesday should be quiet as well with only French business confidence and production indicators on the calendar.

read more ...

EUR/USD edges higher in thin trade

The euro edged higher against the dollar in thin trade on Tuesday as the dollar remained broadly weaker following soft U.S. housing data on Monday.

EUR/USD hit 1.3208 during late Asian trade, the session high; the pair subsequently consolidated at 1.3187, edging up 0.02%.

The pair was likely to find support at 1.3133, Monday’s low and resistance at 1.3253, the high of June 21.

The dollar came under pressure after data showing that U.S. existing home sales fell unexpectedly in June dampened expectations that the Federal Reserve will start scaling back its asset purchase program this year.

The National Association of Realtors said that existing home sales fell 1.2% to an annual rate of 5.08 million units in June, but still remained close to three-and-a-half year highs.

Demand for the euro continued to be underpinned after Portugal’s Prime Minister Pedro Passos Coelho said Monday the current government will remain in office after political leaders resolved a deadlock that had threatened to derail the country's EUR78 billion bailout program.

read more ...

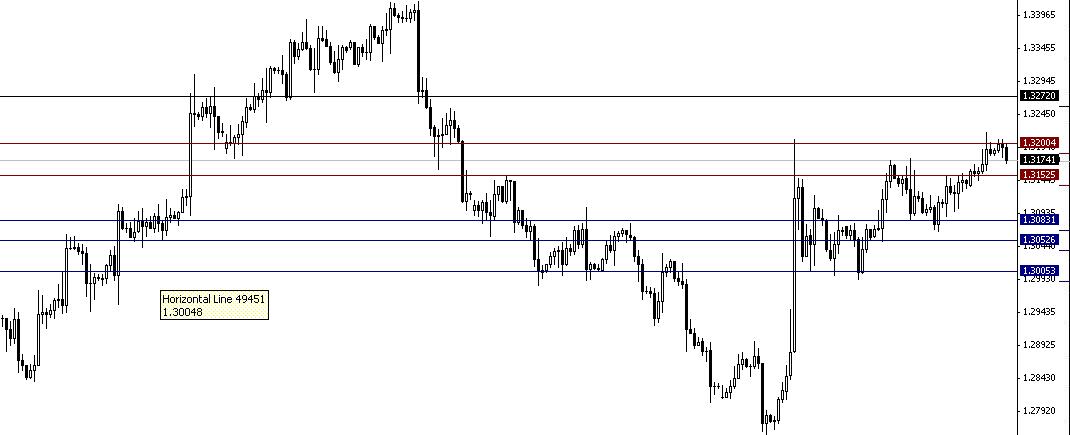

EURUSD Retracing from 1.3200. Will watch price action around 1.3150-1.3140 levels

I think it wants to move up.

Euro slips lower as dollar firms up

The euro edged lower against the firmer dollar in quiet trade on Tuesday as trade volumes in foreign exchange markets remained low due to the summer holidays.

EUR/USD hit 1.3163 during European afternoon trade, the session low; the pair subsequently consolidated at 1.3180, dipping 0.06%.

The pair was likely to find support at 1.3133, Monday’s low and resistance at 1.3253, the high of June 21.

The dollar was broadly lower earlier in the day after data showing that U.S. existing home sales fell unexpectedly in June dampened expectations that the Federal Reserve will start scaling back its asset purchase program this year.

The National Association of Realtors said that existing home sales fell 1.2% to an annual rate of 5.08 million units in June, but still remained close to three-and-a-half year highs.

Demand for the euro continued to be underpinned after Portugal’s Prime Minister Pedro Passos Coelho said Monday the current government will remain in office after political leaders resolved a deadlock that had threatened to derail the country's EUR78 billion bailout program.

read more ...

Flash consumer confidence indicator for EU and euro area

In July 2013, the DG ECFIN flash estimate of the consumer confidence indicator improved markedly in the euro area (-17.4 after -18.8 in June 2013) and, particularly, the EU (-14.8 after -17.5 in June 2013).

NOTE: Following its accession to the EU on 1st July, Croatia is included in the calculation of the consumer confidence indicator for the EU.

June 2013: Economic sentiment improves markedly in both the euro area and the EU

In June the Economic Sentiment Indicator (ESI) improved markedly, continuing last month's increase. Sentiment increased by 1.8 points in both the euro area (to 91.3) and the EU (to 92.6).

source ...

EUR/USD extends modest gains on soft U.S. home sales data

The euro continued to hover higher against the dollar on Tuesday after weaker-than-expected industry data on U.S. home sales released Monday fueled expectations that the Federal Reserve will keep stimulus programs in place for longer than once expected.

Stimulus programs such as the Fed's monthly USD85 billion bond-buying program weaken the dollar to spur recovery.

Fed Chairman Ben Bernanke has stressed that the U.S. central bank will follow no timetable to taper such policies and has added that monetary authorities will pay close attention to economic indicators.

In U.S. trading on Monday, EUR/USD was up 0.21% at 1.3214, up from a session low of 1.3163 and off from a high of 1.3230.

The pair was likely to find support at 1.3144, Monday's low, and resistance at 1.3416, the high from June 19.

The National Association of Realtors reported on Monday that existing home sales fell 1.2% to 5.08 million units in June, missing market calls for sales to rise 0.6% to 5.25 million units in June.

Sales for May were revised down to 5.14 million from a previously reported 5.18 million.

The report added sales were up 15.2% from June of last year, while average house prices jumped 13.5% on a year-over-year basis.

While the numbers indicated that recovery continues in the housing sector, markets concluded the figures were soft enough to sway monetary authorities to keep stimulus programs in place for now, sentiments that carried over into a quiet session on Tuesday.

read more ...