Best Technical FX Trade For 2016: Buy GBP/AUD - BofA Merrill

The up trend in GBP/AUD remains inatct as the cross recently rallied off of support at the bottom of a small channel and the 50w simple moving average.

The rally occurred after momentum reached its most oversold level in a year.

We suspect price will break above the channel, creating a bullish flag pattern. Price pattern measurements estimate targets of 2.3374 and 2.4675.

We recommend a stop with a close below the channel and 50w moving average support of 2.025.

How Many Fed Hikes To Come?...And When? - Danske On Wednesday, exactly seven years after the FOMC lowered the federal funds rate to 0- 0.25%, it raised the rate by 25bp to 0.25-0.50%, which concluded the G10 interest rate decisions in December including in our backyards of Sweden and Norway. Interestingly, all G10 central banks with the exception of Bank of England (BoE) have been less dovish than expected. This suggests that central banks are less worried about the deflationary risks from the collapsing oil price than what many have expected.

Markets initially took the Fed hike well, which reflects that it was the ‘best flagged’ in history. The Fed rate hike removes uncertainty from the market, which is a positive thing, particularly for markets that have been pressured by Fed rate hike expectations such as emerging markets (EM). However, the question remains whether it will be better in the future. More on this below. On Fed, the outcome was broadly in line with our and market expectations. We note that the ‘mean dots’ were moved down by around 19bp in 2016 compared to the September meeting despite the ‘median dots’ being unchanged (see chart 2). In addition, most of the voting members in 2016 will be dovish-to-neutral despite more hawkish regional Fed presidents becoming voting members next year.

We stick to our view that the Fed will hike three times in 2016 and four times in 2017, i.e. a total of seven hikes until year-end 2017. In light of this, we find the current market pricing too soft (see chart 3). The market is pricing Fed to hike in June and in December 2016. This leaves only two full hikes priced in for 2016 and an additional two priced in for 2017. We expect the Fed to hike in April, September and December next year.

We expect the USD to strengthen gradually versus EM and commodity currencies in coming months, as the market prices in slightly higher US rates while staying focused on the collapsing oil price. This week the Argentine peso (ARS) depreciated by 40% after capital controls were lifted, while Fitch downgraded Brazil to junk status. This underlines the continued struggle in EM with or without higher US rates.

We believe that EUR/USD is a very different story, where stretched positioning will mitigate the downside. We expect EUR/USD to range trade between 1.05-1.10 over the coming three months as the market prices in a slightly more aggressive Fed. On 6-12 months, we expect EUR/USD to rise sharply towards 1.16 as the EUR is very undervalued at current levels and the market will eventually realise that we have seen the end of ECB easing.

Pound to Dollar: Deutsche Predict GBP to Fall to 1.35-1.40 Strategists at Deutsche have revised up their forecasts for the EUR/USD pair in 2016 based on concerns about a slow-down in China impacting on the Fed’s tightening trajectory:

“EUR/USD is now forecast at 0.95 at the end of 2016, up from our original 0.90 forecast, in recognition of: i) some prospective impact that risk factors like China will have in restraining Fed expectations holding back the USD versus the majors as described above; and, ii) EUR/USD is set to end 2015 slightly above our original projections, setting a higher EUR/USD starting point for future forecasts.”

Deutsche’s team go on to describe two different possible scenarios, the first in which macro themes are dominated by China’s slow-down, and the second in which they are dominated by Fed tightening:

“In macro terms, how 2016 shapes up will be heavily influenced by whether the main macro driver is the Fed or China.

“If Fed tightening is the driver, USD gains are seen as likely to be slow and broad-based, spread fairly evenly between G4 majors, commodity FX and EM FX.

If on the other hand, China, particularly China FX policy becomes a source of instability, USD gains will be heavily concentrated in commodity and EM FX, while the G4 majors all outperform.”

Goldman Sachs: 21 of the World's Most Interesting Charts

he latest edition of Goldman Sachs' "Fortnightly Thoughts," note is an extravaganza showing what they deem to be the 100 most important charts in the world."Our passion for charts is undimmed and we’re excited about the swathe we have in here, including heat maps, flow charts and our ‘Now and Then’ table showing just how much has changed in the last five years: iron ore down 77%, global smartphone penetration up to 75% from 19%, 89% more robots sold pa, cost of sequencing a genome down 97% and total global market capitalisation up 21%."Here are some of the most interesting from the presentation:

China

First, foreign firms love having Chinese workers.

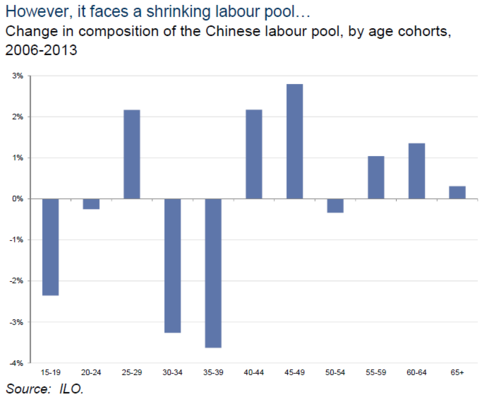

But alas, China might have been too late in getting rid of its one child policy.

You know how wage growth always seems to come up when talking about the Federal Reserve and inflation? Well, when looking at global wages, we're going to need some help from China.

As usual : they have no idea what will happen

What the top 2015 forecasters expect in the year ahead

The crowded consensus is often the wrong place to be

Bloomberg details some of the best forecasters from last year and what they expect in 2016.

Stocks

Goldman Sachs's David Kostin was the top stock market forecaster last year as he predicted a flattish market. Once again in 2014 he sees the S&P 500 rising no higher than 2100 (spot at 2021).

US bonds

Janney Montgomery Scott's Guy LeBas was best last year and sees the 10-year Treasury yield flat at 2.22% compared to the 2.75% median.

Global bonds

Mitsubishi UFJ's Hideo Shimomura was the top global bond strategist last year and is bullish this year, saying low inflation in Australia leave room for the RBA to cut. He also warns about junk bonds.

Currencies

The consensus was right in 2016 and analysts broadly called for US dollar strength. Enrique Diaz-Alvarez of Ebury Partners had one of the most bearish EUR/USD calls and sees the pair hitting 0.95 in the year ahead.

USD: Don't Fear The Fed - BofA Merrill Some global investors expect the US dollar will strengthen enough in 2016 to materially slow down the Fed’s hiking cycle.

While the US dollar may move sharply against some currencies next year, we estimate a real trade-weighted USD index will rise only modestly by end-2016.

Don’t fear the Fed:

What does this all mean for the Fed? In our view, the Fed is likely to tolerate a modest rise in the real trade-weighted US dollar, which is how the Fed assesses the strength of the US dollar.Fed models suggest that a 10% appreciation of this measure, over a year, starts to have measurable impacts upon growth and inflation, and the effects can last for a few years.

The March FOMC meeting may give some additional clues:the broad trade-weighted dollar index had risen over 10% yoy in real terms as of that point, while the major currency index had risen nearly 20%. Those are likely upper bounds on how much of a rise the Fed may tolerate this time around, in part because the full impact of the earlier appreciations are still working through the economy, and in part because growth is expected to be closer to potential and inflation has remained well below target.

Given the size of the forecasted move in the real trade-weighted USD is not all that large by end-2015, we suspect the Fed will be able to look through the increase — in contrast to the not uncommon view that the Fed may have to delay its hiking cycle next year as the dollar rises.

EUR To Face Upside Risk On Unstable Risk; Sell Rallies - Credit Agricole Looking ahead, we remain of the view that risk sentiment will turn more unstable in the weeks to come.

This is mainly due to strongly capped liquidity expectations. Considering the Fed’s more hawkish stance and falling expectations of the ECB and BoJ considering additional stimulus measures this is unlikely to change unless global growth expectations improve more considerably.

Under the above outlined conditions it cannot be excluded that the EUR will face further upside correction risk in the days to come. However, as stressed previously we remain of the view that rallies should be sold.

Even if most ECB members indicated that no more policy action is required, such a stance may change anew should medium-term inflation expectations fall again.

Where To Target GBP/USD, USD/JPY, EUR/USD In 2016? - Deutsche Bank

In a note to clients, Deutsche Bank outlines its 2016 outlook and forecasts for GBP/USD, USD/JPY, and EUR/USD.

GBP/USD:

"In 2016, the GBP is likely to remain vulnerable most obviously against the USD. The pound in particular should suffer from a mix of fiscal contraction constraining the BOE tightening cycle, making a C/A deficit of near 5% of GDP more difficult to finance, most especially in the face of ‘Brexit’ uncertainties. In 2016/7, Cable is expected to test and likely break the 1.35 – 1.40 bottom end of the range that has prevailed for 30 years,"DB projects.

USD/JPY:

"We anticipate that when the USD shows toppish tendencies, the JPY will take the lead, in much the same way is it was at the forefront of the USD resurgence that started in late 2011. Even if the yen does not quite conform to the past pattern of strengthening in Fed tightening cycles, the yen will outperform almost all other currencies barring the USD in 2016, with a USD/JPY peak just shy of Y130,"DB argues.

EUR/USD:

"2016 year-end forecasts have changed slightly, while end-2017 forecasts are largely unchanged. EUR/USD is now forecast at 0.95 at the end of 2016, up from our original 0.90 forecast, in recognition of: i) some prospective impact that risk factors like China will have in restraining Fed expectations holding back the USD versus the majors as described above; and, ii) EUR/USD is set to end 2015 slightly above our original projections, setting a higher EUR/USD starting point for future forecasts," DB adds.

Get Ready To Rebuild Long USD Exposure Into The New Year - BNPP

BNP Paribas continues to expect to see good interest to use recent weaker levels in the USD to build long exposure as we enter the new year.

"US rates markets continue to price a relatively high likelihood that the Fed leaves rates unchanged in Q1, with the implied yield on the April 2016 Fed funds contract just 13bp above the current effective rate.

The pricing is similar to that which prevailed in the January contract heading into Q4 of this year, and the adjustment to fully price December lift-off over the course of Q4 helped the USD gain broadly even taking into account the retreat of the past few days," BNPP argues.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Top 5 FX Market Views For 2016 - BTMU

"In December 2014, we ended the year with a piece outlining what we thought would be our key views for 2015 in the foreign exchange market.

To recap they were 1) US dollar rally set to extend further; 2) Sell-off in emerging market currencies to intensify; and 3) Currencies of low inflation countries to come under renewed selling pressure. We covered just these three key views last year and these views certainly were some of the dominant ones throughout much of the year.

For 2016, we expect the following views to unfold in the foreign exchange market.

1) More strength for the dollar, but less than in 2014 & 2015.

2) Yen strength as the Tokyo policy influence fades.

3) Pound volatility, but on balance appreciation should win out.

4) Scandinavian currency undervaluation likely to ease.

5) Another challenging year for emerging market currencies."

DEREK HALPENNY, LEE HARDMAN - The Bank of Tokyo Mitsubishi UFJ