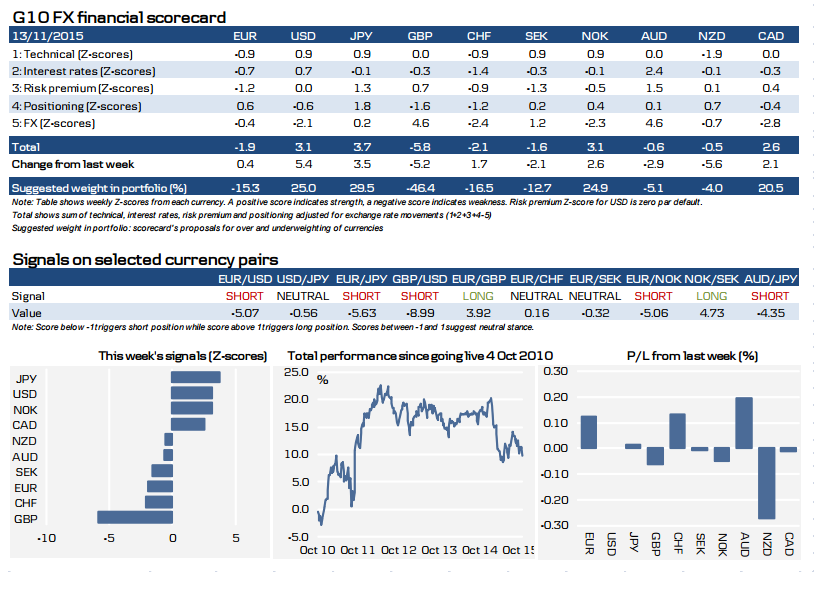

Buy JPY, USD, NOK And Sell GBP, CHF, EUR This Wk - Danske FX Scorecard This week the scorecard recommends buying JPY, USD and NOK, while selling GBP, CHF and EUR (see suggested weights in portfolio in table below).

Last week’s signals resulted in a 0.1% gain. Especially the short EUR and CHF and the long AUD positions performed well, while the long NZD position was relatively expensive.

Next scorecard signals will be sent out on 23 November.

USD Bulls Remain In Control Bullish momentum continues to remain firmly in play for the US dollar on the longer term weekly chart, following the minor pull-back of last week, which saw the dollar index test the new platform of support now in place in the 12,155 area (as denoted by the pink dotted line). This was the resistance level duly breached as the index soared higher, driven by a very bullish figure for November’s monthly nonfarm payroll release, and closing the week at 12,210.61.

This bullish move higher was, as expected, following the rising triangle that had been building on the chart since late May, with the series of higher lows coupled with the continued testing of resistance in the 12,100, combining to create this strongly bullish signal, with NFP then providing the catalyst to drive the index through this level. So far this week, the 12,155 platform has held firm and continues to remain bullish in this timeframe.

Week Ahead: Further Unwinding But Don't Go Cold Turkey On USD USD lost ground even though the October minutes made a stronger case for a December lift-off. It appears that market expectations about the aggressiveness of the Fed tightening beyond December have become an important FX driver. Unless incoming data indicates accelerating growth momentum, the Fed should continue to signal a very cautious pace of tightening in an effort not to dampen investors’ growth and inflation expectations.

Next week’s data calendar is fairly empty with Thanksgiving likely to dampen market activity. We could see further unwinding of USD longs but doubt that investors will go cold turkey on the USD. Going into the December meeting we remain in favour of buying USD dips, in particular against JPY and NOK.

Contrary to our expectations, risk sentiment has improved even as Fed rate hike bets intensified. It appears that rising US growth expectations and the ECB’s dovish monetary policy stance have more than offset the Fed-driven tightening in US monetary conditions. However, given capped global growth expectations, commodity prices have remained under pressure. We are still bearish on commodity currencies like NOK, especially when considering that Norges Bank can ease further.

What we’re watching:

EUR – Next week’s PMI releases will unlikely have any meaningful currency impact, especially as the ECB does not seem to react to improving growth prospects for now.

GBP – Limited room of further rising rate expectations should keep GBP upside limited. Better GDP data is unlikely to change such conditions.

USD – In the absence of any top tier data releases the USD may suffer on the back of profit taking. However, USD should remain a buy on dips. Next week’s backward looking GDP will not change the firm rate expectations.

JPY – Weak inflation data may reinforce the view that the BoJ will have to ease monetary policy further in order to reach its inflation goal.

XAU – Limited room of further rising Fed rate expectations could make gold subject to upside risks.

EUR, JPY, GBP, CHF, AUD, CAD: Weekly Outlook - Morgan Stanley

EUR: More Weakness to Come. Bearish.

EUR is likely to remain an underperformer in the current environment. Monetary divergence between the ECB and the Fed should keep the currency under pressure. The main risk to our EUR view would be a selloff in risk into the first Fed hike. This would likely drive some repatriation and funding unwinds, which would support EUR given its funding status. Overall, we maintain our bearish view.

JPY: Gains on Crosses Likely. Bullish.

,JPY may weaken against USD into the first Fed hike, but we are much more upbeat on the currency on crosses, and even against USD over the medium term. The central bank has pushed back the timing of its 2% inflation target, buying time before it needs to implement further easing. In addition, we believe the government may help the central bank by increasing fiscal stimulus, which would be JPY positive.

GBP: Bearish Risks Rising. Bearish.

The new dovish tone from the BoE, fiscal tightening and a looming Brexit debate could keep GBP under selling pressure for now. GBPUSD remains sensitive to global risk appetite and rate differentials. Core inflation rising last month is not enough to support GBP we believe and like to sell on rallies. This week we will be watching the GDP and business investment data for any signs of slowing, indicating heightened Brexit concerns.

CHF: Long USDCHF. Bearish.

USDCHF is rapidly approaching its 1.0240 high before the removal of the EURCHF floor in January. We believe that the upside momentum in this pair will continue at least until the ECB meeting in December. Aggressive ECB policy in December may support the SNB cutting rates further in coming months if it sees a risk to EURCHF falling too fast. The SNB’s Jordan has emphasized the need to keep monetary policy divergences to weaken the franc.

CAD: Time to Go Short. Bearish.

We remain bearish on CAD. The fall in oil prices seen recently will have a lasting negative impact on the economy, and the central bank may need to respond. Indeed, the rebound seen in the non-commodity sector is fizzling out, evident in manufacturing data and non-commodity exports. With further easing not priced in as of yet, the currency could weaken if the BoC is forced to take a more dovish tone in the future. We enter a long USD/CAD position.

AUD: AUD Tactically a Regional Outperformer. Bearish.

AUD could see some tactical strength in the current environment, particularly against its commodity currency peers. The RBA painted a more encouraging picture on growth, arguing the fall in mining investment could be nearing an end, and that prospects for economic improvement have improved slightly. However, the central bank sounded more concerned about external factors and inflation, which will keep AUD a relative, not absolute, outperformer.

Stay Short EUR/USD, Short AUD/USD...& Other FX Plays - RBS The following is RBS' latest trading strategy for this week.

ECB President Draghi says the ECB will do what it must to raise inflation quickly. More currency weakness is consistent with that thinking. With the Fed likely to raise rates in December, policy divergence prospers. Stay short EUR/USD.

No changes in our other views: Stay short AUD/USD and stay long USD/MYR.

Sterling does relatively well as markets are likely to drag forward first tightening expectations into the first Fed rate rise. Stay short EUR/GBP.

ECB seizes currency war from Japan. Stay short EUR/JPY. Stay long JPY/KRW

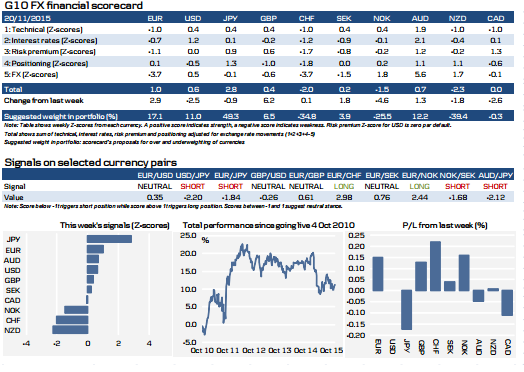

Buy JPY, EUR, AUD And Sell NZD, CHF, NOK This Wk - Danske FX Scorecard This week the scorecard recommends buying JPY, EUR and AUD while selling NZD, CHF and NOK (see suggested weights in portfolio in table below).

Last week’s signals resulted in a 0.4% gain.

Next scorecard signals will be sent out on 30 November.

Trade Ideas For EUR/USD, AUD/USD, NZD/USD, USD/CAD - UBS

The following are UBS' latest short-term trading strategies for EUR/USD, AUD/USD, NZD/USD, and USD/CAD.

EUR/USD:The risk of a short squeeze can't be ruled out, but the pair should remain under pressure ahead of the ECB's meeting next week. Keep playing the short side but only get more involved if the pair moves closer to 1.0700. We expect buying above 1.0500 and would be surprised to see a move below the year's low ahead of the ECB.

AUD/USD:Stick to playing AUDUSD from the short side, with a stop above 0.7250. Support at 0.7160, 0.7115 and 0.7050.

NZD/USD:Fade NZDUSD rallies between 0.6580 and 0.6650, with a stop through 0.6750.

USDCAD: We would square longs and look to sell intraday rallies between 1.3370 and 1.3400, with a stop through the September high of 1.3460, targeting a test of 1.3250. A break below 1.3250 could open up a test of the mid-term uptrend line that comes in around 1.3080.

EUR/USD: Decisive Down Target; GBP/USD: H&S Top - SocGen

EUR/USD breached the flag formation within which corrective recovery since March evolved, notes SocGen.

"The pair is approaching towards previous lows of 1.05/1.04, a decisive level for a larger down move," SocGen argues.

"Short term upside is likely to be capped at 1.1085," SocGen projects.

Turning to GBP/USD, SocGen thinks that a break below 1.5080/1.50 will confirm H&S formation and lead to retest of graphical support at 1.48 and even towards 1.45

"Short term recovery if any, is likely to face resistance at 1.5530," SocGen adds.

Which currency pairs are giving the strongest momentum signals - BNP? The following are the latest signals from BNP Paribas FX Momentum which measures the strength of a currency's trend based on FX price action, rates and equities.

"The USD's bullish momentum remains strong with a score of +63. All components of our momentum indicator - FX, rates and equities - have moved in favour of the USD in recent weeks.

On a currency pair basis, the strongest momentum signals are bullish USDCHF and USDNOK and bearish GBPNOK and GBPCHF," BNPP notes.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

EUR, JPY, GBP, CHF, NZD: Outlooks For The Coming Week - Morgan Stanley

"EUR: Watching the ECB. Bearish.

We remain bearish on EUR, and expect diverging monetary policy to weaken the currency. In the run up to the December ECB meeting, markets are likely to focus on upcoming comments from central bank members, particularly as there are some signs of a divide over how far to go in December. For EUR to overshoot our revised forecasts, we need risk appetite to be strong so EUR is used as a funder.

JPY: Gains on Crosses Likely. Bullish.

We see scope for JPY to continue its gains and be a G10 outperformer. Expectations of easing from the BoJ continue to fall, as the central bank has pushed back the timing to reach its inflation target and data has been mixed. We’ll watch the upcoming GDP print closely as stronger growth is likely to further bolster JPY. We like being long JPY on crosses into December given expectations for a Fed hike.

GBP: Bearish Risks Rising. Bearish

The new dovish tone from the BoE, fiscal tightening and a looming Brexit debate could keep GBP under selling pressure for now. GBPUSD is becoming increasingly sensitive to the price of oil, therefore we need to be watching that more. A mixed employment report, showing that services wage growth may be slowing, could keep the BoE on hold for longer. This week the focus will be on inflation and retail sales data for October.

CHF: Long USDCHF. Bearish.

Diverging monetary policies between the ECB and the Fed support long USDCHF positions again. USDCHF is sitting close to the March highs and we believe a clean break could provide further upside momentum. Aggressive ECB policy in December may support the SNB cutting rates further in coming months if it sees a risk to EURCHF falling too fast. The SNB’s Jordan has emphasized the need to keep monetary policy divergences to weaken the franc

NZD: Use Rebounds to sell NZDUSD. Bearish.

We would use any rebounds in NZDUSD as selling opportunities. Dairy prices are no longer rising and the RBNZ has expressed strong concerns about this. An RBNZ rate cut is not required to weaken the NZD, we believe. Being a high beta currency, the NZD will weaken in times of higher US rates, which the markets are currently in the process of pricing in. Weakness in commodity prices generally should also support our bearish NZD view."