Trading The FOMC Minutes - Views From 10 Major Banks

Citi: There is not much reason for the Fed to give hawkish steer via Minutes, as their FOMC caution was vindicated by subsequent events. Since FOMC we have had Yellen testimony (pretty dovish), Brexit and a couple of dovish comments from other FOMC members. Also the surprise of the last FOMC was the new, much more dovish configuration of dots so they are more likely to use the Minutes to explain the shift than unwind it.

Morgan Stanley: Fed minutes from its June meeting will be due on Wednesday. The Fed should err on the side of caution, particularly with its views ahead of the Brexit vote and the weak 38k payrolls. Last year, US NFP rose by a healthy 229k monthly average. Some hiring slowdown should be expected as the labour market hits full employment, but for the market to regain confidence that the US economy is in good shape, this Friday’s NFP may have to beat the consensus 166k while simultaneously showing that wage growth has accelerated further from its last 2.5% reading.

BNPP: Today sees the release of the June FOMC minutes and, while the meeting took place before the UK referendum, we expect the minutes to highlight a range of concerns and uncertainties keeping the Committee in check, consistent with yesterday’s speech by New York Fed President Dudley, who noted a weaker than expected investment outlook. All of this does not bode well for the USD generally, but with political concerns continuing to weigh on the GBP and, to a lesser extent, the EUR, and with a fragile risk environment challenging the EM and commodity exporter currencies, the dollar is unlikely to fall broadly.

TD: The dynamics underpinning Fed policy have been overtaken by the post-Brexit events, making the June FOMC minutes somewhat stale. Nevertheless, we expect the tone to be dovish, reflecting a greater awareness among Fed officials about the negative feedback loop from global events. We also look for an increasing acknowledgement of the persistence of the structural headwinds constraining growth, which has underpinned the dovish revisions to the projected policy path.

BTMU: The release today of the latest FOMC minutes from their mid-June meeting are expected to reiterate that the Fed is in no hurry to resume rates hikes in the near-term, and imply that the Fed will require even more time to re-assess the outlook for the US economy and policy following the Brexit vote. Prior to the Brexit vote, the Fed’s updated projections signalled that it was planning to raise rates at least one more time this year which appears less likely now but not completely ruled out. The release of the ISM non-manufacturing survey for June will also be watched closely today to assess if the US economy is regaining a firmer footing after the weak start to the year. The employment sub-component has been worryingly weak heightening concerns over the health of the domestic economy. A rebound in the employment sub-component would bring some much needed relief. Another weak non-payrolls report poses the main downside risk for the US dollar in the near-term.

RBC: The Fed releases Minutes from its June meeting today. It is unusual for the Minutes to reverse the market’s take on the original statement/rate decision but that is what happened last time around. Recall the April statement was seen as very dovish while the minutes (released on May 18) led to a USD rally and repricing of rate expectations. That seems much less likely to happen this time around given that the meeting came a week ahead of the UK vote to leave the EU – comments on global conditions will be seen as dated in that light.

Barclays: At the time of the June FOMC meeting, we believed that the chair and the committee were clearly ready to raise rates but were concerned over the May labor market report and had some concern over potential side effects from the UK referendum. On balance, we believed that the committee generally minimized the weakness in labor markets, saying that the “pace of improvement in the labor market has slowed” but said it expects that “labor market indicators will strengthen” more and that one month’s data do not make a trend. We look to the minutes to judge the number of participants concerned about the labor market slowdown. We expect that a few members will have read the slowdown as reflecting a weaker outlook, that some will judge it as part of an expected slowing in labor markets, and that most will state that it is too early to judge. We also look for a discussion on inflation expectations, given the mid-month drop in the University of Michigan measure just before the June meeting. Those members predisposed to hike rates in the near term will view the dip as transitory and insignificant; those wishing to delay a hike likely noted concern over the dip.

BofA Merrill: The minutes of the June Federal Open Market Committee (FOMC) are already stale in light of the unexpected vote for Brexit.While we anticipate extensive discussion of the risks to the outlook given the decline in the dots, we expect the Fed will need to further scale back its planned interest rate path at upcoming FOMC meetings. The relative outperformance globally of US data was the main reason the April minutes sounded optimistic about a possible June hike; the key thing to watch in the June minutes is how Fed officials assessed the recent slowdown in US data, particularly the labor market, and how concerned they were about adverse global spillovers. The overall tone is likely to be cautious and thus dovish, although markets have moved further to price in some chance of a rate cut by December. We think a cut then is quite unlikely, and do not expect the minutes to advocate for additional policy easing this year – although Fed officials will always keep their options open. Market focus will be on discussion about the shift in the dot plot, particularly since it was accompanied by limited changes in the economic projections. Views on the productivity outlook are likely to feature prominently in this discussion, and there appears to be an active debate among Fed officials about whether the slowdown in productivity is permanent, what are its causes, and what it implies for monetary policy. The minutes may also reveal debate about the presentation of the dot plot, especially since St. Louis Fed’s Bullard slashed his dots and declined to give a long-run projection for the funds rate. Incorporating some indication of forecast uncertainty into the dot plot is one potential future change.

Credit Agricole: The June FOMC minutes will garner less interest than usual from market participants as the Fed’s risk management approach rules out any near-term policy moves, in our view. The tone of the minutes will likely be much more cautious than the late April minutes, which highlighted the discussion of a potential rate hike this summer. By contrast, in June, the Summary of Economic Projections (SEP) showed a shallower expected path for rate normalization and included a rise in the number of participants expecting only one rate hike this year. The key FOMC discussion points in our view were 1) the sharp deceleration in job growth and 2) the lower equilibrium Fed funds rate seen by many Fed officials. The slowdown in job growth raised concerns that the economy’s forward momentum had stalled. This called for a cautious data-dependent policy with no preset course as Fed officials awaited additional data that would validate (or not) their expectations for continued solid growth and employment gains this year. We believe the minutes will show that Fed officials were, on balance, cautiously optimistic that 1) Q2 GDP growth had rebounded and 2) the recent payroll slowdown may have been a lagged effect from the slowdown in overall activity in Q1 and would reverse with the pickup in Q2 economic activity, as suggested by Chair Yellen.

SEB: Prior

to the this meeting a number of FOMC members had been out guiding

market towards a summer hike. But that prior to the weak employment

report which clearly was a game changer. With respect to the minutes, any indication of what officials would like to see before hiking rates again would therefore be interesting to see. After the Brexit vote we have revised our Fed forecast to a December hike.

No Signals From FOMC Next Week; More Likely At Jackson Hole On Aug 26

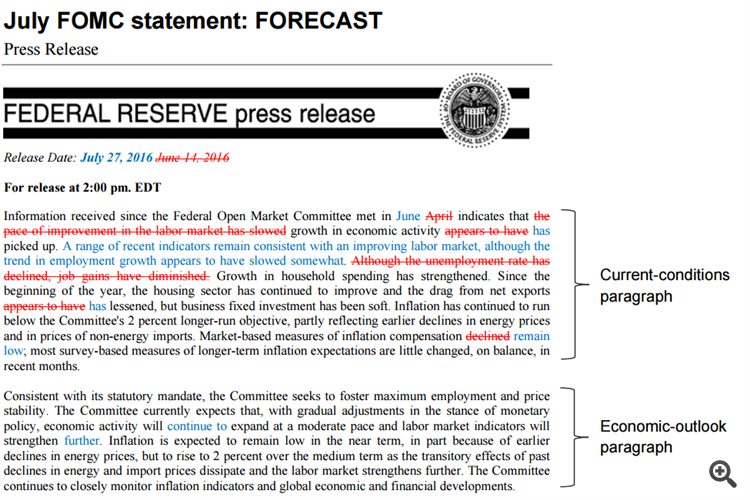

We expect the Fed to leave the target range for the federal funds rate unchanged at 0.250.50% at its July meeting as it debates to what degree the softening in employment growth owes to transitory factors and the extent to which risks from abroad have diminished. Given competing views on the committee, the statement will have to strike a careful balance between acknowledging that June employment rebounded sharply and accommodative financial conditions following the UK vote against the desire to see further evidence that labor market momentum will keep the economy in an above-potential growth path.

Too much caution would remove optionality for a September hike (our baseline) and likely preclude the possibility of two hikes before year-end. Participants will also be reluctant to place too much weight on the rebound in employment in June. Altogether, we see the July statement as striking a fairly neutral tone as the committee acknowledges improvement while awaiting the Q2 GDP report and July employment data.

Altogether, we expect no change in the target range for the federal funds rate in July and believe the statement will acknowledge the improvement in activity and labor markets during the intermeeting period. That said, we believe the statement will signal that the committee needs further evidence that labor markets and activity will support further progress toward the dual mandate before signaling to markets that another rate hike is forthcoming.

We

do not expect this signal at next week’s July FOMC meeting and,

instead, see Chair Yellen’s appearance at Jackson Hole on August 26 as a

more likely time for a shift in tone. By this date, the

committee will have Q2 GDP, July employment, and observed market

reactions to anticipated easing by the BOJ (July) and BOE (August) in

hand.

Preview of the FOMC meeting this week - expectations

Here are a few bits and pieces from around the place in the past few days on what to watch for from the Federal Reserve this week

- The FOMC meeting is Wednesday, 27 July 2016

- Announcement due at 1800GMT

- Not expecting a rate hike, nor much in the way of a signal on when the next hike is due

- Statement will reference improving economy and labour market; the June employment data will do more to convince the poor numbers in May were an aberration, but one month's report will not be enough to convince the FOMC to 'change its tune'

- Barclays now looking at Yellen's appearance at Jackson Hole for more information, that's "a more likely time for a shift in tone"

- Yellen will have the Q2 GDP & July employment data by then

BoA / Merrill Lynch:

- Says its likely the FOMC statement will acknowledge generally better data, but say the FOMC will continue to monitor inflation & global risks (Brexit impact especially)

- FOMC to leave the door open to a September rate hike

- But not expecting to get any no clear signal on September.

- BoA / ML say their base case is a December hike

Deutsche:

- No rate hike this meeting

- Economists expect the FOMC to say the labour market employment trend has slowed somewhat, but gains are enough to lower the unemployment rate

- Expect the statement to be thus moderately upbeat

- Not expecting a strong signal for a September move

FOMC: On Hold This Week; BoJ: 50% Probability Further Easing This Week

USD: FOMC Rate Decision (Jul. 27)

UBS expects the FOMC to leave rates unchanged in its upcoming meeting, and hike only in December by 25bps. By that time, the Fed will have a half-year of evidence with which to assess the post-referendum impact on the financial markets and economy, as well as gauge the strength in domestic economy.

JPY: BoJ Monetary Policy Meeting (Jul. 29)

Our economists think, at the same time as government economic measures are being drawn up, the BoJ will conduct additional easing at 50% probability for July, 30% for Sept, 10% for Oct-Dec, and 10% for no easing this yeaJuly FOMC: Minutes Are A Greater Market Risk

The July meeting of the Federal Open Market Committee (FOMC) is unlikely to result in any policy changes by the Fed, in our view. In fact, we do not expect the Fed to give any signals about September or subsequent meetings, maintaining its data dependent approach to a gradual hiking cycle. Markets will likely be looking for any clues of how this week's meeting will set up Fed policy decisions at subsequent meetings this year. Our base case remains that the Fed will next hike in December, but a September move cannot be completely ruled out. We believe the bar to hike then, however, is relatively high: the US activity data would need to remain solid, inflation indicators generally would need to point higher, and global risks would have to settle down to a dull rumble.

Our base case of a more optimistic tone to the July statement, given better data on net, should lead at most to a modest increase in market-implied probabilities of hikes this year. More substantive language changes are unlikely, in our view, but would be more market moving if they occur. Perhaps the biggest risk to market pricing will come not from this week's statement, but from the minutes in three weeks' time. Recall the sharp market reaction when the April minutes revealed significant support on the FOMC for a possible June rate hike. There is the potential for a similarly surprising amount ofFOMC interest in a September hike this time around.

Minutes: Surprise factors?

While the statement is not likely to be particularly market moving, in our view, the minutes (released three weeks later, on 17 August) could contain more scope to potentially surprise markets. The April minutes (released on 18 May) noted that"most"participants thought conditions might allow the Fed to hike in June, and markets sharply repriced accordingly. We see an elevated risk of a repeat with the July minutes. The minutes also will be watched for just how much support remains on the Committee for two hikes this year, and whether the longer-run dots might be reduced further.

Speaking of the dot plot, the Committee may spend some time discussing how to further improve the information conveyed by the Summary of Economic Projections, particularly the dot plot. The recent abrupt change in dots recorded by St. Louis Fed President Bullard-including his refusal to submit a long-run dot-has brought this communication tool to the fore again. Some change to highlight the degree of uncertainty in the policy projections seems likely in our view, although an agreement on how best to do that may not be reached at the July meeting.

source

Will FOMC Help Or Hurt The Dollar?

Taking a look at the day-to-day change in the U.S. dollar, it may seem that there was very little consistency in the performance of the greenback ahead of Wednesday’s monetary policy announcement. However if we isolate the price action to the U.S. session, the dollar moved higher against most of the major currencies. Tuesday morning’s U.S. economic reports were mostly better than expected with consumer confidence beating expectations and new-home sales rising sharply. Service-sector activity slowed according to Markit Economics and house prices dropped slightly but that was not enough to deter investors from buying dollars pre-FOMC. During a time when central banks around the world are actively talking about and planning for easing, the Federal Reserve’s hawkish bias will shine a bright light on the dollar. Many feared that the Fed would give up on the idea of tightening after Brexit but as we have seen, U.S. markets and the U.S. economy have proven to be fairly resilient.

The following table shows more improvements than deterioration in the U.S. economy since the June Fed meeting. Retail sales increased, nonfarm payrolls rebounded strongly with job growth rising 287k in June, the housing market is chugging along, manufacturing- and service-sector activity are on the rise. U.S. stocks also hit record highs while plunging U.S. yields provide support to the economy. The currency has strengthened across the board but the strongest gains were against the British pound. We’ve also heard from a number of FOMC voters since Brexit and they still seemed to support the idea of tightening. The FOMC statement generally reflects the views of the Fed leadership (Yellen, Fischer and Dudley) and it is likely to recognize the improvements in the economy since June. Of course, there will still be notes of caution and everything will be “data dependent”, but we expect the main takeaway to be that a 2016 rate hike remains on the table. The Fed needs to move forward with policy normalization and it can’t wait around for the U.K. to invoke Article 50, which could take up to 2 years. So we expect the dollar to trade higher into and after FOMC. There won’t be fireworks but there could be some quick trading opportunities.

What Analysts Think the Fed Will Do Today?

With the July outcome of the Federal Open Market Committee (FOMC) due later on Wednesday, the market is speculating about what the FOMC might actually come up with.

With the probability near zero that the FOMC will go ahead with an interest rate hike in July, most market analysts see December as the most likely time for a move.

Below is a summary of the opinion of analysts and economists from major investment banks around the world.

- Barclays: Do not expect FOMC statement to push up market expectations of a September move higher in rates, but acknowledge recent improvement in data. Barclays see a rate hike possibility as early as in September and for signaling to be made at Jackson hole meetings.

- Citibank: Do not expect any action despite strong economic figures. Yellen's Jackson Hole speech is in spotlight. Citibank sees first rate hike in December this year most plausible.

- BNP Paribas: Don't expect Fed to take any action, BNP sees 25 basis points rate hike in September.

- Commerzbank: Fed will not raise rates in July, statement is likely to give no real clues to Fed's further action. Commerzbank sees rate hike more likely in December.

- Bank of America Merril Lunch: Unlikely to change policy in July, or give any signals about September or subsequent meetings, maintaining it is data dependency. BoFa analysts see rate hike in December.

- RBC: Do not expect a rate hike, statement unlikely to make a "grand proclamation". RBC sees rate hike in June 2017 at the earliest

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

2 Key Points To Watch In June FOMC Minutes

The June FOMC minutes will garner less interest than usual from market participants as the Fed’s risk management approach rules out any near-term policy moves, in our view. The tone of the minutes will likely be much more cautious than the late April minutes, which highlighted the discussion of a potential rate hike this summer. By contrast, in June, the Summary of Economic Projections (SEP) showed a shallower expected path for rate normalization and included a rise in the number of participants expecting only one rate hike this year.

The key FOMC discussion points in our view were 1) the sharp deceleration in job growth and 2) the lower equilibrium Fed funds rate seen by many Fed officials. The slowdown in job growth raised concerns that the economy’s forward momentum had stalled. This called for a cautious data-dependent policy with no preset course as Fed officials awaited additional data that would validate (or not) their expectations for continued solid growth and employment gains this year.

We believe the minutes will show that Fed officials were, on balance, cautiously optimistic that 1) Q2 GDP growth had rebounded and 2) the recent payroll slowdown may have been a lagged effect from the slowdown in overall activity in Q1 and would reverse with the pickup in Q2 economic activity, as suggested by Chair Yellen.

The discussion over the lower potential rate of growth, due to soft productivity growth, likely suggested structural reasons for expecting a lower natural Fed funds rate to persist for some time. This view supported a shallower trajectory for the path to rate normalization.

Lastly, it will be interesting to note the level of policymaker concern over a potential shock from the Brexit vote. Chair Yellen said that the results could be significant for markets and indeed the tightening of financial market conditions following the vote has pushed back any consideration of a rate hike, in our view, until very late this year at the earliest.

source