USD/JPY: Pair Stable, Pinned to ¥123 The pair was seen oscillating around the ¥123 mark yet again on Thursday, with no impetus to move during European trading hours and therefore remained unchanged on the day.

During the US session, initial jobless claims are due, but these weekly labor market statistics are not expected to spur any significant market movement, with the main focus on several Fed officials' speeches later on Thursday.

"Later this afternoon we also get to hear from a host of Fed speakers including Fed Chief Janet Yellen, Charles Evans, Jeffrey Lacker and William Dudley, all voting members on the FOMC. This will be the first time we've heard from Ms. Yellen since last Friday's bumper payrolls report so it could be instructive if she has any comments about firstly the jobs report itself, and secondly the sharp rise in the US dollar," Michael Hewson, chief market analyst at CMC Markets wrote in the emailed note to clients on Thursday.

Furthermore, investors are waiting for Friday's major US data, including the retail sales report for the month of October - which are expected to improve from September levels - as well as wholesale inflation and the University of Michigan consumer confidence gauge.

From the yen point of view, industrial production for September is due during the Asian session, along with capacity utilization, but again, these data rarely create any volatility.

USD/JPY climbs as stocks pare gains Sentiment recovering

The S&P 500 has pared declines and is trading down 6 points to 2040 after falling as low as 2026.

The recovery in stocks has boosted USD/JPY to 122.97 after falling as low 122.40 in the post-retail sales dip.

The correlation with stocks is tight at the moment. Money is flooding into the US because it's still the best place in the world for developed growth. In the old days, the money would find its ways into short-dated bonds for carry but in the zero-rate world it goes into stocks and junk bonds.

USD/JPY: Dollar Drops Over Week, Corrects Below ¥123 The week was notably more calm then the previous payrolls one and the pair ended lower, due to the ongoing US dollar correction and some disappointment in US data. It closed the week 0.42% lower at ¥122.64.

Tuesday brought somewhat positive macro figures from Japan, when the Japanese current account for September decreased from ¥1,653 billion to ¥1,468 billion, while analysts had expected an improvement to ¥2,180 billion. The trade balance posted a surplus of ¥82.3 billion, up from a deficit of ¥326 billion previously.

The first US data of medium importance came out on Thursday, when initial jobless claims stayed at 276,000, while continuing jobless claims somewhat worsened, from 2,169K to 2,174K.

The main focus on Thursday was on several Federal Reserve (Fed) speakers, yet nothing new was provided with Janet Yellen actually completely avoiding any monetary policy talk, which caused some selling on US dollar pairs and the USD/JPY pair dropped below the ¥123 level.

On Friday, Japanese industrial production in September improved somewhat, with the monthly print showing growth in production of 1.1% from 1.0% a month before, while the year-on-year change came out at -0.8%, up from -0.9% previously. Meanwhile, capacity utilization in September accelerated from -0.9% to 1.5%.

USD/JPY: Pair Edges Higher and Crosses ¥123 Mark The US dollar opened with a bearish gap on late Sunday and dropped to levels around ¥122.20. However, the gap was closed and the pair erased all losses as it was trading above the ¥123 higher during the London session.

The risk-off flow hit the markets after Friday's terrorist attacks in Paris and the stock markets dived, but this should have only a small impact on the currency markets.

The pair is expected to continue being bid on dips as long as US yields push higher and the odds for the December rate hike remain around 65-70%.

Earlier in the session, Japanese GDP fell short of expectations and disappointed. The annualized gauge in Q3 improved from -1.2% to -0.8%, while analysts had expected -0.2%. The quarter-on-quarter result ticked higher from -0.3% to -0.2% and also missed estimates of a -0.1% print.

Moreover, the GDP deflator accelerated in Q3 from 1.5% to 2.0% and came out above estimates of 1.7%.

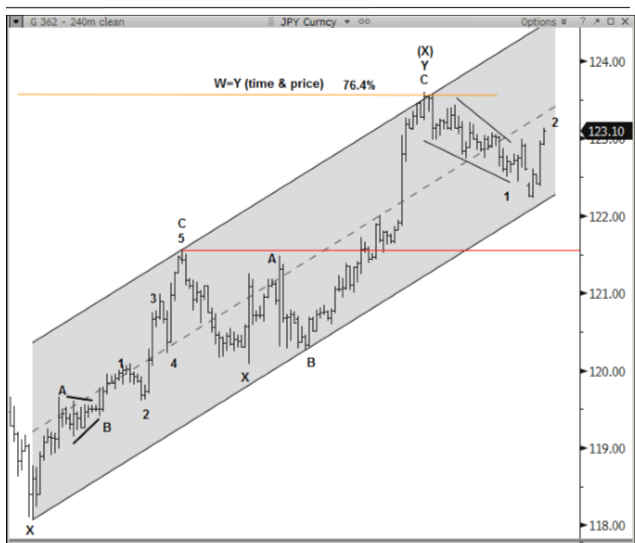

USD/JPY: A Reversal To Start Wave-3 Down - Nomura USD/JPY completed Elliott pattern completed on 11/9 at channel resistance, a Fibonacci retracement & a symmetry target.

"Also promoting our call for a tradable high was a key cycle date on 11/10. So far the decline has been choppy but we consider this a wave-1 leading diagonal (wedge) and this overnight spike is marking wave-2. S/t, resistance is 123.44 and critical at 123.60," Nomura argues.

"Because the decline was unclear, we cannot rule out that this sell-off was a counter-trend bull flag. We favor a reversal from current levels to start wave-3 down," Nomura projects.

USD/JPY: Greenback Eases Below ¥123 The Japanese yen was strengthening against the US dollar and the pair dipped below the ¥123 mark and also managed to break below the bullish trend line, which might be further negative for the pair in the near future.

During the London session on Friday, the USD/JPY was trading mildly lower around ¥122.80.

"The BoJ today announced that it would begin to release its favored measure of CPI on the same day as the government releases the monthly CPI data. The annual CPI rate excluding fresh food and energy has been trending higher and currently stands at 1.2%," analysts at Bank of Tokyo-Mitsubishi wrote on Friday.

On Thursday, the Bank of Japan (BoJ) left monetary policy unchanged, with the main rate remaining at 0.1% and the annual pace of QQE was kept at ¥80 trillion as widely expected.

"It is another sign that the BoJ is reluctant to implement additional monetary easing and wants to counter any potential risk of speculation building. We continue to expect no additional easing by the BoJ," analysts added.

The macro calendar is empty on Friday and therefore volatility might be lower as the weekend approaches. Market participants will likely focus on the Federal Reserve's John Williams and his discussion in Atlanta on the US economy. Williams is currently a voting member on the Federal Open Market Committee, so his comments will be closely followed.

USD/JPY forecast for the week of November 23, 2015 The USD/JPY pair initially tried to rally during the course of the session’s the made-up the previous week. However, we ended up turning back around and formed a shooting star by the time we closed. With this, it looks like the USD/JPY pair may end up being somewhat soft in the short-term, but we think there is more than enough support below to keep this market going higher. Somewhere above the 120 handle, we think that a supportive candle would be a nice buying opportunity as the market should then reach towards the 125 level.

USD/JPY: Pair Recedes From ¥123 as Yen Enjoys Safe-Haven Status The Japanese currency was broadly purchased on Tuesday after Turkey said it shot down a Russian warplane, launching a moderate safe-haven rush despite the US economy growing over expectations in the third quarter.

The yen enjoyed its safe-haven status even though US economic growth data showed relatively upbeat numbers which helped to push the pair over $122.50. Nevertheless, the data driven correction proved to be temporary.

The pair fell briefly below the $122.40, it's intraday low, but quickly bounced slightly higher before meandering around the ¥122.50 mark, slightly lower on the day, and extending its pullback from more than two-months highs.

The US economy accelerated by an annualized 2.1% in third quarter, meeting expectations, fresh figures from the Department of Commerce showed on Tuesday. In the previous period, the economy had grown by a much more robust 3.9%.

Nevertheless, the momentum was essentially borrowed from the next quarter as inventories will need to be depleted further. On the downside, consumption-related components were mildly weaker.

Earlier, the trading sentiment was shaped primarily byJapan's upbeat manufacturing data and poor sentiment on Asian equities.

Japan's manufacturing sector remained in a solid expansionary state in November, growing at the strongest rate in 20 months, helped by strong growth in new export orders.

Preview: Anemic Inflation, Spending to Amplify Kuroda's Headache Tomorrow's CPI and household spending data is forecast to be broadly disappointing, with headline inflation likely to remain in negative territory and spending to be flat, putting greater pressure on policymakers to avoid another deflationary spell which could put further strain on already-anemic demand.

Japan's core CPI measure, which tracks the change in prices of consumer goods excluding fresh fruit, is forecast to decline 0.1% year-on-year in October, unchanged from the pace seen a month earlier.

The further-stripped CPI gauge, which excludes both fresh fruit and energy prices, is expected to rise 0.8% over the same period, easing from 0.9% in September.

Tokyo's price index, released a month earlier than the national measures, is forecast to slide 0.1% year-on-year in November, slightly better than the 0.2% decline in October.

Whatever way the figures are looked at, inflation is no where near the Bank of Japan's (BoJ) elusive 2% target, despite having extremely loose policy settings in place for almost three years now.

BoJ Governor Haruhiko Kuroda and his board recently pushed out their expectation for reaching the 2% price target from fiscal 2016 to fiscal 2017, as weaker export growth and continued softness in global oil prices threatened to delay a rebound in inflationary pressures in Japan.

USD/JPY to 130? Nomura remains bullish on USD/JPY

USD/JPY has been trading in a narrow range around 120 so far in 2015, notes Nomura

"After appreciating strongly in 2013 and 2014, the pace of USD/JPY appreciation slowed as we expected. However, we still do not think USD/JPY has peaked. As the Fed is finally about to embark on its tightening cycle, we expect USD/JPY to resume appreciating toward 130 in 2016," Nomura projects.

"Given monetary policy divergence and expected strong JPY selling by Japanese investors and businesses, we expect USD/JPY to keep trending higher

We are currently flat in JPY positions, but into 2016 we recommend keeping a USD/JPY long bias," Nomura advises.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

USD/JPY: Pair Anchored to ¥123 The dollar has been trading around ¥123 the whole day, even though the initial morning dip was bought, but the pair failed to remain above this mark.

Chinese industrial production in October ticked lower from 5.7% to 5.6% Chinese industrial production in October ticked lower from 5.7% to 5.6% year-on-year and missed estimates of a 5.8% print, while the year-to-date gauge also decreased from 6.2% to 6.1%. Retail sales in October only marginally improved from 10.9% to 11.0%, while investment in non-rural fixed-assets decelerated from 10.3% to 10.2%.

The news failed to spur any significant volatility and the risk-on approach was evident during the London session.

On Tuesday, the Japanese current account for September decreased from ¥1,653 billion to ¥1,468 billion, while analysts had expected an improvement to ¥2,180 billion. The trade balance posted a surplus of ¥82.3 billion, up from a deficit of ¥326 billion previously.

read more