Ok, I've vaguely laid out the general theory of the system by hinting at other systems. I'll more directly outline the very BASIC version of my system. What I hope this thread to develop in to are various versions of my system. As you'll see in my subsequent posts, nearly any trading strategy can be applied to the system to form another variation, but there are still some very basic rules that must be followed. What I'm trying to discuss/present is more an idea just as how pyramiding into a position is more of a method than it is a system.

Perhaps explaining the title of my thread will help.

TP Tree Method

There are hundreds of martingaling threads. What do they do? They double up or increase the lot size after every lost trade to hopefully win it all back in one trade. It's a very dangerous strategy to implore and I don't recommend it; at least for novice traders. You will go broke eventually. Essentially the trader is increasing their risk on each trade. Volatility of their equity can be massive. After a string of so many losses you could be risking 30% or more of your account to try and profit just 1%. That is terrible risk/reward.

Then, after reading tkimbles weekly scalping system it hit me. Why do we increase the risk in martingaling? It doesn't make sense and doesn't seem necessary to me. Why not martingale our TP? Here is what I mean:

1. Presume we enter long trade in a currency for 1 lot at 1.5000. We have a TP/SL of 50/50.

2. The trade goes against us and our SL is hit at 1.4950.

3. Immediately enter a SAR trade to sell short 1 lot at 1.4950 except this time our TP/SL is 100/50.

4. This trade ends and hits our TP. Instead of keeping TP stagnant at 50 and only profiting +0 on the two trades, we've ended +50 with the second 100 TP trade.

Again, the idea is essentially exactly the same as tkimbles, but I'll show you that there can be extreme variations to tkimbles method that could prove VERY interesting in later posts.

What happened though? Did we increase risk? No. Our lot size on the trade was exactly the same as on the first. Our SL was 50 just as it was on the first trade. We only increased our reward, which can't be a bad thing. Can it?

Let's go back to step three in the above example.

3. Immediately enter a SAR trade to sell short 1 lot at 1.4950 except this time our TP/SL is 100/50.

- At this point our total pips lost would be 50.

4. This short trade reverses on us and now we are in a long SAR trade at 1.5000. Our TP/SL is now 150/50. The 150 is trying to overcome the previous two losses and still profit +50 on the third trade

- At this point total pips lost would be 100.

This is interesting. In terms of our TP we have increased it by only 300% from the initial trade. If we were to be martingaling in the traditional sense then we would have had to increase RISK by 400% to get to the same level of profitability. On the next trade if we were to compare the series, then martingaling would have increased RISK by 800% while the methods I'm presenting here have increased the TP level by only 400% of the original level. I hope you can see how this plays out. The spread between increasing TP and martingaling risk increases dramatically after each trade. I'm only pointing out my reasoning for questing peoples desire to martingale risk.

So TP Tree Method. I called it that because the premise of the system is to grow the TP levels as necessary in a 'trade series.' For some reason the first thing that popped in my head was that the TP was branching out like a tree. That is the second time I've mentioned the term 'trade series.' Let me explain what I mean by this. To do that we'll need to go back to step 4 above.

4. This short trade reverses on us and now we are in a long SAR trade at 1.5000. Again, trade size is only 1 lot. Our TP/SL is now 150/50. The 150 is trying to overcome the previous two losses and still profit +50 on the third trade

- At this point total pips lost is 100.

5. Our TP is hit on this long trade and we profit 150 pips. This overcomes our previous two losses and puts our account at +50 pips net.

6. Immediately enter a new trade in the same direction as the last with 1 lot. This time, reset the TP/SL back down to the initial 50/50 of our initial trade.

7. Repeat this cycle of increasing TP after each lost trade to overcome the previous losses until a TP is hit and you reset back to the initial TP/SL of 50/50.

It's difficult to put in to words for me, but a trade series in the above example would be the initial trade and all the trades up to the trade that ended in TP. Once the TP is hit then a new trade series is begun.

At the very heart of it that is the most basic way I can explain the basis of the system. We create a tight range of SAR SL triggers to prevent any large losses and hopefully put us in the direction of the trend to win the big trades. That is essentially what tkimbles methods are doing, but they're closing their trades based on time rather than performance. I'm proposing using set TP levels to improve efficiency. This allows us to close trades more often in profit, and depending on the range you're using, put you closer and closer to the peaks and valleys of a chart.

Again, tkimbles methods and mine are betting that price will eventually leave a certain price range. Theoretically this should be a scalping system to get that price range as small as possible. I'll touch on that later. As shown by some of the success by tkimble weekly scalping traders, the premise of the system holds true on larger ranges. What happens is that using larger ranges essentially acts like using a 10 MA versus a 50 MA to get your signals. The trades will take longer and you'll be playing a different time frame. Again, more on this later.

Feel free to begin to comment or ask questions on anything. I'm about to get into more specific system variations to hopefully get your mind thinking on ways to trade this idea.

I feel it necessary to explain some of the characteristics of the system that I noted in my original post. If you recall, they were:

1. No indicators.

I haven't mentioned a single indicator yet, and I don't plan to. I'm sure some of you will use indicators to determine the direction of the initial trade, but I don't think it will improve performance drastically. The idea of the system is to let the market dictate your trades rather than you trying to predict them.

2. No concern for market direction.

I just made this point above. We let the market tell us where it is going. We're only along for the ride.

3. Initial trade could have a risk/reward ratio of 3 risk : 1 reward and you'll still end in profit.

I'll touch on this in the next post as this is variation I want to speak to.

4. It can profit in both a ranging and trending market.

We can profit in ranging markets because our initial trades are 'small.' They give us the ability to profit on small moves, while also take hold of larger moves since we're entering trades immediately after a TP and increasing our TP for potentially large moves.

5. Even if 10,000 people are trading this system, it could/would be impossible for anyone to tell when those people are entering the market. There is no general entry point.

There are a variety of reasons for this. The first is, I imagine the basic premise will make its way into different types of systems. Scalping, trending, fast, slow, etc.. The second is that say I trade a 50/50 TP/SL system on gbp/usd with the exact same rules that you do. I could enter the market at 1.4950 and you could enter at 1.5000 and the system should still work for the both of us. There is no set point on a chart that you NEED to enter your trades at. I'm sure some here will eventually enter their trade series at areas of support/resistance, but I'm fine with just letting the system run 24/7 and taking it all in stride. That's why I believe 10,000 people could trade this system to success and the market would never know about it.

Now I'd like to discuss variations of the implementation of the above basic principle. I'll start with the statement that my initial trade could have a terrible risk/reward ratio of 3 risk : 1 reward. Instead, I'll change it to 10 risk : 1 reward just to make the math simpler and prove my point just as well.

How many noob threads are there that say something like, "All I need is 10 pips a day and I'll be rich! I'll set my TP to 10 and SL to 100 and I'll hit winners 95% of the time!" Unfortunately, the noobs never think about what happens when they finally do hit that 100 SL. Hell, I've even started one of those threads I think. Please don't bother looking for it. I don't like to talk about it. Time will tell if I want to talk about this one either.

Anyways, I've taken the above TP/SL of 10/100 one step further. If we were to apply this threads principle to a 10/100 system then what would we do?

1. Enter a long trade at 1.5000 of 1 lot with TP/SL of 10/100.

2. Trade gets stopped out.

- We're now down 100 pips.

3. Immediately enter a SAR short trade at 1.4900 with TP 110 and SL 100 for 1 lot.

It's that simple. Our risk/reward on the SERIES has now turned positive. Who cares about losing that one trade that had the terrible risk/reward? Have you ever made enough to retire on 1 trade? I sure hope not, because you most likely got lucky you didn't lose it all. When we view the trades as a series that we can toy around with the risk/reward, then the possibilities really open up.

I'll touch on money management later, but I believe compounding profits is much more powerful than winning fewer big wins. It's in the math. Begin with $1000 and roll your profits from every win in to the following trade. If you win 20 trades that add and then compound 1% each time then you now have $1220.19. If you add and compound two 10% wins from $1000 then you have $1210. Compounding many times over is a very powerful tool.

So to get back to the TP/SL 10/100, it is very possible you'll hit that 10 TP several times in a row just based on market noise. Each time you hit that TP, compound the profits and enter the new trade with 10 TP 100 SL. I imagine this system produces many strings of winners. I personally don't prefer this method because in terms of risk management, I like to base it off of the SL. So risking 2-3% for that 100 SL will produce only .2-.3% profit on each trade series. That's fine by me, but I think another method not incorporating that initial terrible risk/reward trade will prove more fruitful.

MARTINGALING

There, I said it. I know I know. I mentioned earlier that martingaling is dangerous and will blow your account easily. Let me explain. Martingaling, in my opinion, is a valid trading methodology when used in moderation. The crux of this system is if the TP level outpaces the volatility of the market. Meaning, what happens if we get whipsawed several times which increases our TP to 500 or 600 pips? It will take forever to complete the trade. The same holds true even if our TP is only 20. If after a string of losses it is increased to 160 or more, it will feel as if the system has hit a wall since we're used to winning trades after 1-5 SL's.

So we have to find a way to prevent those SL's from expanding our TP too fast. We want the market to have a chance at completing the trade series. This is something traders should seriously consider before using. I'll touch on money management later, but I am happy with trading a system that risks only .1% on the trade. Yes, that is 1/10%. To me, a traditional risk for a trader is around 2-3%. This means, I am able to martingale, ie double, my lot size on each trade after a SL for 4 rounds and still trade at a level below what most other traders risk per trade. 1.6% < 2%.

I am willing, as a trader, to risk just .1% of my account on my initial trade such that I can double up my risk to prevent having to increase my TP size for several rounds. Thus if I were to be trading a 10/10 system, my TP levels would be 10-10-10-10-10-20-30-40-50-60 for the first 10 trades in that series. I hope you see the power that this brings. The smaller we keep our trading range for longer the better. Depending on success and statistical studies on the system, I would like to get to a point where I no longer increase lot size and that risk per trade shrinks to the point that I can double up another round, still risk less than 2% on the last martingaled trade, and still provide a relatively liveable amount of cash.

Again, martingaling is a very risk method to trade, but I hope you realize that it can also help if used with maturity and discipline. It helps prevent the sigma 9 event of the system, but doesn't solve it.

Now is a great time to discuss money management.

Money Management

This entire system/premise is essentially money management. There are no indicators or concern over market direction. We are expecting that our money management and trade setup will allow us to remain in the game long enough to allow the price to fluctuate out of our range to hit our TP. That's it.

Here is a key point of the money management that we can NOT overlook. In my previous posts I always said that each trade was entered with 1 lot. 1 lot. 1 lot. I never said, "enter a trade with 2% risk. Enter a SAR trade with 2% risk." This is because we must NEVER decrease our lot sizes on any trade in a trade series. If on the initial trade of the series we enter with 1 lot, then on the 15th+ trade of that series we must still be trading with 1 lot. If we were to trade with 2% on each trade then our lot sizes would decrease as our equity shrinks after losses. We can not do this or else the power of the pips on the later trades in a series would not hold enough weight to make up for the losses in the previous trades.

Here is what I mean. Assume we lose 3 trades in a row on a series.

Balance Risk $Value per pip on a 10 SL

Trade 1 1000 1 lot $1

Trade 2 990 1 lot $1

Trade 3 980 1 lot $1

Trade 4 970 1 lot $1

Our pips must be of equal value on every trade in a series. If we were to determine lot size on % of account then here is how risk would look in the above system.

Balance Risk $Value per pip on a 10 SL

Trade 1 1000 1% $1

Trade 2 990 1% $.99

Trade 3 980.1 1% $.9801

Trade 4 970.29 1% $.9703

As you can see, the value of the pip decreases. This means when we finally hit TP, it may not actually overcome the previous losses since the previous loss pips were of higher value.

NEVER decrease lot size in a trade series. Lot size should only be reconfigured once TP is hit and a new trade series is started. Then recalculate whatever % of your account you want to risk and go with it. Compounding has incredible power, and thus I believe we should look to increase lot size with every new beginning trade series. This doesn't mean to go from 1 lot to 2 lots on the next series. I mean to find a microlot or minilot broker, depending on your account size, such that you can go from 1 lot, to 1.02 lots, to 1.05 lots, etc.. That will add up really quick. It's better to manage your money and compound.

Are you afraid not decreasing lot size after the losses will increase risk dramatically? Think again.

If we don't martingale and use 1% on the initial trade to determine lot size then here is how the risk per trade will play out.

Balance Initial Risk Actual Risk per trade

Trade 1 1000 1% 1%

Trade 2 990 1% 1.01%

Trade 3 980 1% 1.02%

Trade 4 970 1% 1.03%

As you can see, it doesn't really increase our risk per trade enough to consider decreasing lot sizes. On the 20th trade in the series we are still only risking 1.22% based on the adjusted account size after the 19 losses.

Now let's look at a martingaling approach. We'll start with .1% risk though and stop martingaling once we hit 1.6% risk relative to the initial trade.

Balance Initial Risk Actual Risk per trade

Trade 1 1000 .1% .1%

Trade 2 999 .2% .201%

Trade 3 997 .4% .403%

Trade 4 993 .8% .812%

Trade 5 985 1.6% 1.651%

Trade 6 969 1.6% 1.679%

As you can see, actual adjusted risk per trade does not increase dramatically even with martingaling. On the 20th trade you will be risking 2.195% as a risk for the adjusted account balance after 19 losses in a row. You would have lost 31.9% of your account at that point. That sounds pretty reasonable to most any other trading system if you ask me. That's an average risk per trade of 1.595%.

I hope you can see what money management can do for you though. Eventually as I can begin to analyze results I'd like to determine if ending a trade series after so many losses would prove more efficient than letting it run as much as it wants. I do not want to end a trade series because of poor money management that does not allow me to safely continue the series.

Now to move on to same last minute thoughts.

That is the majority of my views in a nut shell. Like I said, there are many variations and strategies to consider. You could do the following.

- Shoot to complete only 1 trade series a day such that your account is increased by whatever your initial risk is. If you martingale the first few trades then make sure your account can handle a string of losses. This point leads into the next strategy however.

- Allow the system to trade only during certain periods of the day. There are apparent times of the day when certain currencies are volatile depending on which banks are open. It might make sense to, rather then let the system run for 24/5.5, run the system for only 3-6 hours out of a day, let the last series close, and then enter no new trade series' until the next days 3-6 hour window.

- Create this method as a hot button such that you only hit a button to enter an initial trade long or short. You could use this around key areas of support/resistance to trade just as you normally would, but this gives you the ability to profit if your initial hunch is incorrect. This goes along with looking to complete only one series a day.

- Perhaps you don't look to end in profit after so many trades in a series, or at all. Maybe you only want to profit on the initial trades and hope to get lucky many times. That could delay/slow the growth of your TP levels. For example, if you martingale then the TP levels could go 10-10-10-10-10-10-20-30-40-50 on the first 10 trades. You don't martingale the first trade and it allows you to add one more trade that doesn't increase the TP. That could increase the probability of hitting TP drastically, but again you're not really profiting except for when TP is hit and you hopefully hit two TP's in a row.

I'll end by saying how I would like to test and then trade the system.

After speaking from someone I respect in currency trading, I believe that not one system is going to make you rich. You can't depend on a trending system to make you rich when the market is ranging and vice versa. So what do you do? You trade both systems so long as they both have expected returns of 1.5 to 1. Thus, when one is winning 1.5, the other is only losing 1 to produce a net profit of .5. I believe the same must be instituted with this. My mentor noted somewhere around 6-9 systems at once is what produced the general best efficiency of reducing drawdown and increasing profits.

By system I don't mean an MA system, an RSI, elliot wave, etc.. He considered the same 'system', but played on two loosely correlated currencies to be two seperate systems since they should produce different signals, results, and trading patterns.

So in my opinion I would like to see this system built such that initial risk per trade is .1% of the account. Martingale the first trades until trade size hits 1.6% and remain at that point on every subsequent trade in a series. Next, trade this method on 3 different loosely correlated, but major currency pairs. Lastly, trade each currency pair three times, but with different ranges. This means on GBP/USD I could be trading this system, but one with a 20/20 TP/SL, another with 40/40 and another with 60/60. Trade similar ranges again on two other currency pairs to effectively be trading 9 systems.

In chart form it looks like this:

Currency GBP/USD USD/JPY EUR/USD

Trade Sys1 20/20 20/20 20/20

Trade Sys2 40/40 40/40 40/40

Trade Sys3 60/60 60/60 60/60

So you're trading three currencies three times over. This should help reduce drawdown since it is unlikely every single time frame on every single currency will be going to 10+ SL's in a row. Hopefully, the other systems will be hitting TP's and compensating for the other 'systems' SL's. Trading 3 currencies with only 2 time frames, aka different ranges, or 2 currencies with 3 ranges should be good enough too.

Do not trade with the figures I've given above. I have not traded in this manner. I have not tested these figures. I simply wanted to get the ball rolling, and for people to think of variations to tkimbles method that could be useful.

The reason I began this thread is to collect more ideas beyond my own, although I'm not interested in making this system overly complicated. I think it's simple enough and solid enough to work. The success of tkimbles method gives me hope. Really the EA just needs to be made once and then saved several times over with different currency pairs and TP/SL range specifications.

I see the only way this can be traded is by EA. I would hope someone is kind enough to put this in to code. Without any indicators it might be easy enough, although the money mangement may be tricky.

I now open the floor for discussion, criticism, and all else. I hope I've provided something of use.

Matt

im not really understand, can u give a picture example ?

Sure. I'll try to explain it by showing a trade that would go wrong.

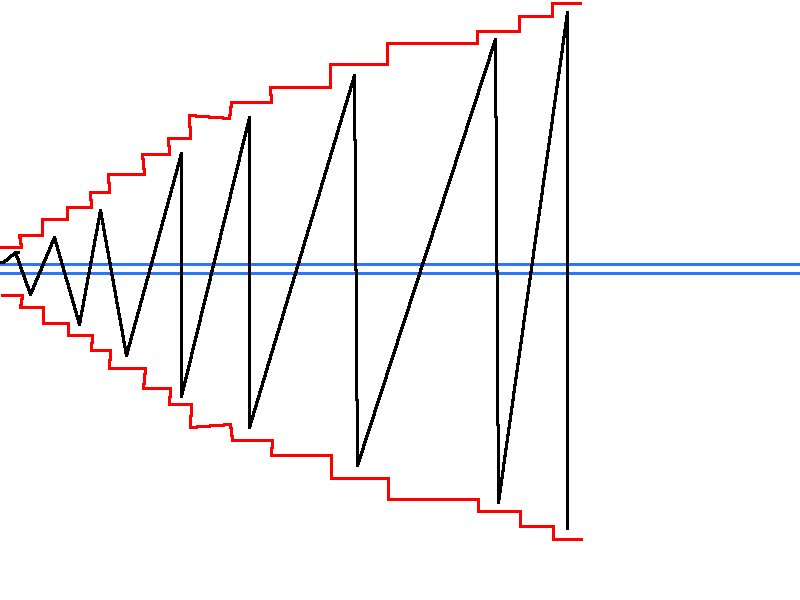

The black lines indicate price.

The blue lines indicate our SL points. These SL points are SAR trades. So when the top blue line is crossed from below, then we enter a long trade after exiting our short trade that just hit SL. This is reversed when price crosses the bottom blue line from above.

The red lines indicate out TP levels after getting stopped out on our trades. Again, this is a worst case scenario where price can not keep up with our expanding TP levels.

What should you notice though? The SL and SAR points never change. We don't increase our SL. As trades get stopped out, our TP level expands to hopefully hit the one trade that puts us back in positive territory. Price would have to break out of this range for it to happen.

As you can see, the problem of the system is if we get whipsawed and TP levels expand faster than the price can keep up with. That is why I recommended martingaling the first 4 trades after the initial SL to prevent having to expand the TP level until the 6th trade.

I'm not sure how else to explain the system, but feel free to ask questions.

Matt

Hi. Yes, the 'apparent' risk is better than a martingaler, but as you are successively increasing the TP, you are decreasing the probability of your TP being hit considerably! So regarding the possible 19 successive losers you mentioned and using 50 pips, this would equate to a 950 pip TP, versus a 50 pip SL - which do you think probability would favour being hit first! So, though I haven't tried coding it, I feel certain that this will blow your account just a quickly as a martingaler would (probably sooner)...

EDIT: I thought you wrote 30 losers - corrected. I'll just add that even so, the probability of further losers continues to increase with this strategy, whereas with martingalers, the probability is fixed - the trade-off is that the money at risk isn't! imo, this strategy has exactly the same risks...

Hi. Yes, the 'apparent' risk is better than a martingaler, but as you are successively increasing the TP, you are decreasing the probability of your TP being hit considerably! So regarding the possible 19 successive losers you mentioned and using 50 pips, this would equate to a 950 pip TP, versus a 50 pip SL - which do you think probability would favour being hit first! So, though I haven't tried coding it, I feel certain that this will blow your account just a quickly as a martingaler would (probably sooner)... EDIT: I thought you wrote 30 losers - corrected. I'll just add that even so, the probability of further losers continues to increase with this strategy, whereas with martingalers, the probability is fixed - the trade-off is that the money at risk isn't! imo, this strategy has exactly the same risks...

Yes I understand. As mentioned, the system will need tweaking.

In response I'll say that I'd first like to see the frequency at which a 50/50 would actually go to 10 or more SL's especially if it is given 5 trades to complete at 50/50 TP/SL because of martingaling. Then, dependent on analysis, find a point at which it makes more sense to reset the entire system.

What I mean by that is, if we have 8 or more SL's in a row, would the system more quickly recoup the loss if you just started over rather than waiting for the next trade to hit 300-400 pips TP? This will also have to take into account the actual profit that arises from compounding the previous trade series before it.

Something else to consider as a possibility is what I mentioned earlier about only trading during the volatile hours of the day. I'm not sure how useful that would be on a 50/50 or 100/100 system however. For a scalping system that would make sense. Perhaps for a larger system like that I would implement the other idea I mentioned earlier where we look to only complete one series a week on that range/currency configuration.

Considering the success of the tkimble weekly scalping method on FF, I think it would be easy to deduce a point at which we stop trading that certain currency/range configuration. We martingale for the first trades, and maybe cap it at 7-9 trades total where TP is around 200 pips. Not unreasonable for a weekly method. If this provides successful weeks 80% of the time, then accepting that sort of loss should be ok. We're likely to still gradually increase our account.

At this point I'd like to just try though. It can't hurt.

BTW, 19 SL's in a row on a 50/50 TP/SL system would actually require a 750 pip move since I'm looking to martingale the first couple of trades. I'm not so sure this system will blow an account faster than a complete martingaling system. As you'll see from my math in the 5th post, even after martingaling and losing 20 trades, you would only be risking an adjusted risk of 2.195%. Average risk of the 20 trades would be 1.595%. That can't be said for a martingaling system whose risks gets blown out of proportion.

I'd say considering that kind of math to support our money management, and an eventual look at resetting after some 'uncle' point, I don't think this stands a good chance at blowing an account.

Thank you for being critical though. Seriously. I'd really like you to respond to this post too.

Thanks,

Matt

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Howdy folks,

I posted this on FF and figured I share here too. Please be critical and open minded. I'm presenting more of a method just like how Fibonacci Numbers aren't necessarily a system, but something you use in a system. I do post further down a system I think would be interesting to try using the methodology I discuss.

I would greatly appreciate it if someone could code an EA for this that is adjustable. I've never trade this live as I don't see that as possible. There will be tweaking to be done.

Anyways, I hope you enjoy the ideas presented, if they haven't been already elsewhere. Feel free to say hello at least. On to the discussion:

Welcome to the TP Tree Method.

I hope those reading and replying in this thread will enjoy this system. Much of the methods are already present in other threads on this forum.

Some interesting characteristics of this system:

1. No indicators.

2. No concern for market direction.

3. Initial trade could have a risk/reward ratio of 3 risk : 1 reward and you'll still end in profit.

(I hope I didn't give anything away there.)

4. It can profit in both a ranging and trending market.

5. Even if 10,000 people are trading this system, it could/would be impossible for anyone to tell when those people are entering the market. There is no general entry point.

(Again, I hope I didn't give it away right there.)

I'm not entirely sure how to present this method. I'll begin and see where it goes.

The idea for this system is very much a permutation of Tkimbles Weekly and Daily Scalping methods. You can view those over at FF. I don't know if I can link here.

Essentially for tkimbles weekly scalping method you would place a straddle trigger at the opening of a weekly candle. Once one of the straddle points is hit, you enter a 30/30 TP/SL trade. The SL is a 'stop and reverse' entry trigger. You let the trade ride all week and continue to SAR around that 30 pip range. Hopefully a general trend will develop during the week to close the week near the high/low, and thus overcoming any losses on the whipsaws you occured.

Those systems have shown to work to some extent. I have always believed them to be very inefficient however. This is because I believe the reason those systems work is far different than what the traders of those systems believe is the reason for why they work.

Beyond the straddle entry points off the open of a daily or weekly candle, those systems incorporate SAR trades. If their long trade is triggered then they adjust the SL to the previous short sell trigger. They then place SAR trades around a tight range until, hopefully, a trend is determined that carries price away from the SL far enough to overcome the previous stop lossed trades and end in profit. By happen chance, using a time range, such as closing the open trade at the end of the daily/weekly candle, has proven somewhat profitable.

I don't believe ending at the end of a candle really means anything however. I also don't believe placing straddle triggers around any price has any merit for this type of system either. I say this because I believe the real theory driving the system is that we're willing to suffer through several stop lossed trades to eventually hit that big winner that exits the range we've set and puts us back in profit.

Before I go into more detailed manners, I'll end this post to act as my Wiki. Hopefully, if there is enough interest, great ideas will be generated that will need to be tracked. This first post will act as the index for posts, files, and the like.

Please be courteous, but critical. Now, on to the system.